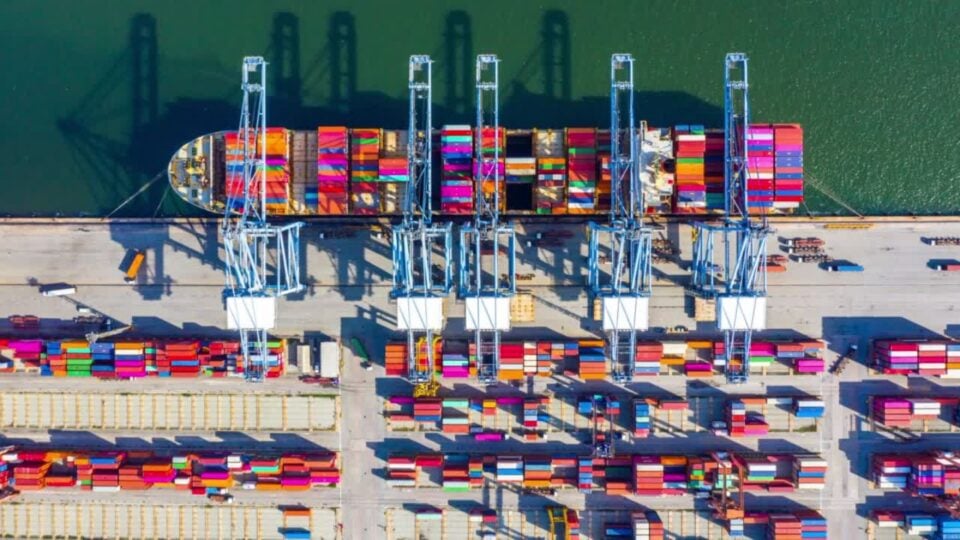

Asia-Australia Trade Lane: Market Conditions and Rate Outlook

Ocean freight markets across Asia saw notable shifts in October, driven largely by China’s...

Read moreService update: Severe flooding and rainfall impacting services East-West & North-South. View the latest update here.

With 2025 well underway, Northline’s General Manager, International Freight Management, Rob Baigent, provides insight on some key external factors, and how they will influence the Ocean Freight market outlook for the year ahead.

For the past four years, the industry has seen ongoing disruptions within the container shipping sector, a pattern that seems unlikely to change over the next 12 months. With significant political and economic uncertainties remaining, ocean freight key indicators such as service, rates, capacity and demand will continue to be impacted:

In terms of service and rates, disruptions to services continued leading into and over the Christmas and New Year period. Rates remained a little higher than compared to the same time last year, as carriers implemented numerous blank sailings in an effort to create demand and maintain rates at these levels. However, rates fell to pre-pandemic levels leading into Chinese New Year due to low booking demand.

We expect demand to increase, and additional capacity to be slowly introduced on Oceania trade throughout February and March as China opens back up and applies an increased focus on this trade (in light of the pending U.S tariffs). Equally, heightened demand will support an uplift in rates as carriers open up for contract discussions through February and March.

Ocean freight markets across Asia saw notable shifts in October, driven largely by China’s...

Read moreNorthline's International Freight Management Operations & Customer Experience Manager...

Read more