Asia-Australia Trade Lane: Market Conditions and Rate Outlook

Ocean freight markets across Asia saw notable shifts in October, driven largely by China’s...

Read more

What does this mean for the International Freight Market?

Last week’s announcement to reduce reciprocal tariffs to 10% between China and the USA for the next three months has seen an increase in demand for Trans-Pacific trade. This has prompted supply chain operators to make the necessary adjustments, albeit this will come with consequences and further uncertainty.

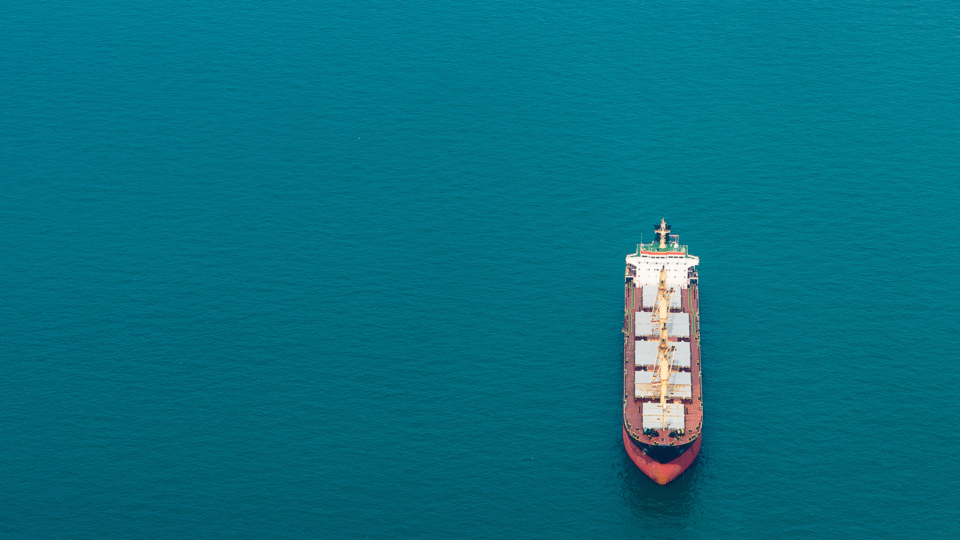

Prior to the tariff agreement, carriers cancelled over 85% of their vessels heading to the US market. We also saw the redeployment of all larger vessels on Trans-Pacific trade to other trade lanes, such as Oceania. This created space in surplus of demand and subsequently the FAK rates on the East Coast and West Coast of Australia dropped.

Since the announcement, all shipping lines and vessels on Trans-Pacific trade are already fully booked for the rest of May, leaving carriers scrambling to either reschedule vessels back to Trans-Pacific trade or to deploy additional vessels to accommodate the demand. Carriers such as Cosco Shipping and CMA-CGM Group have been very quick to respond.

This will see us maintain a critical focus on rate levels, demand and equipment, covering:

Ocean freight markets across Asia saw notable shifts in October, driven largely by China’s...

Read moreNorthline's International Freight Management Operations & Customer Experience Manager...

Read more