Asia-Australia Trade Lane: Market Conditions and Rate Outlook

Ocean freight markets across Asia saw notable shifts in October, driven largely by China’s...

Read more

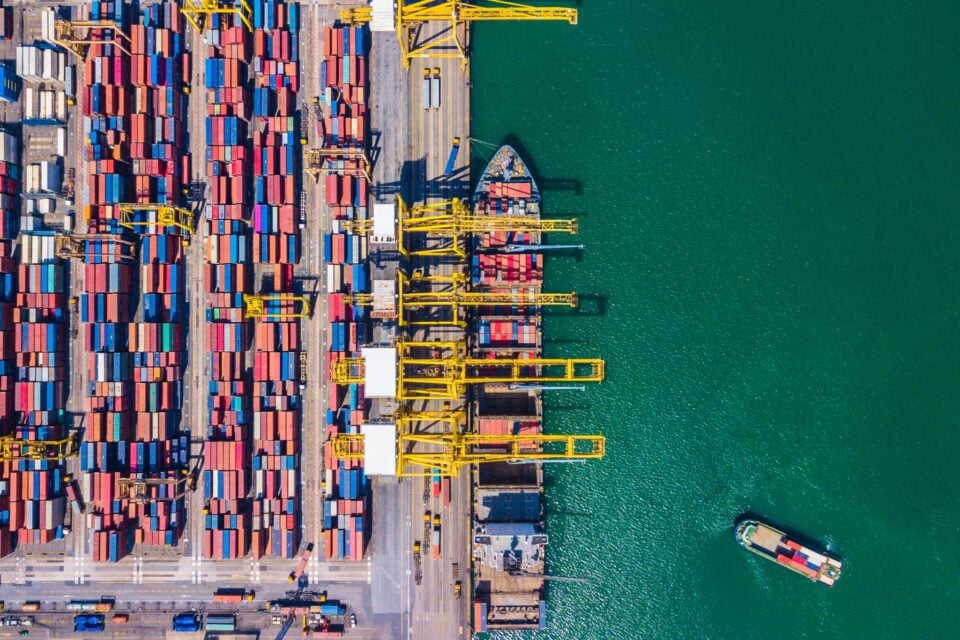

Global shipping markets remain influenced by a mix of economic conditions, geopolitical developments and shifts in supply and demand across key trade lanes. While some regions are seeing strong volumes and steady rates, others are experiencing capacity imbalances, pricing changes and ongoing operational challenges.

This update provides a snapshot of recent trends and conditions in major global shipping routes.

Global financial conditions have improved slightly but overall economic growth is still slow. While higher tariffs have given some sectors a boost, uncertainty in the market is holding back trade activity.

Recent data from S&P Global shows that global business growth slowed between April and June, with a dip in June likely linked to tensions in the Middle East, the ongoing war in Ukraine and political uncertainty in the US.

The Israel-Gaza conflict continues to disrupt shipping routes in the Red Sea, making global trade more sensitive to developments in the region.

Despite these challenges, freight volumes moving in and out of Europe remain strong.

The risk of shipping through the Strait of Hormuz has eased following the ceasefire between Israel and Iran. However, freight rates are still high with an additional “War Risk” charge in place.

On the Transpacific route, there’s currently more shipping space than needed. To manage this, carriers are reducing the number of sailings which can lead to containers being delayed and moved to later departures.

In the Asia-Europe market, conditions remain steady with shipping capacity well matched to demand and freight rates holding firm.

For shipments from Asia to the east coast of South America, space is tight and carriers are considering a rate increase between July and September to manage demand.

On the Transpacific route, shipping prices (spot rates) are still moving up and down, with a recent drop overall. Rates to the US West Coast have fallen sharply, while those to the East Coast are easing more slowly.

In northern Europe, ongoing port congestion is pushing freight rates higher, with further price increases expected in the coming weeks.

Demand for shipping to the east coast of Latin America is strong, driving rates up significantly, over 120% in the past month. In contrast, rates to the west coast of Latin America are expected to fall.

The 9 July pause on US reciprocal tariffs was extended to 1 August, with new rates of 15-39% set to apply unless bilateral agreements are reached. A universal 10% baseline tariff remains, excluding China, which has a separate extension to 12 August and a further 90 day reprieve to mid November.

As of early August, the US imposed new tariffs on over 60 countries with retailers already seeing cost increases flow through the supply chain.

Ocean freight markets across Asia saw notable shifts in October, driven largely by China’s...

Read moreNorthline's International Freight Management Operations & Customer Experience Manager...

Read more